Life Insurance in and around Aurora

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

People sign up for life insurance for a variety of reasons, but the primary reason is normally the same: to secure the financial future for your family after you pass away.

Coverage for your loved ones' sake

Life happens. Don't wait.

State Farm Can Help You Rest Easy

When it comes to picking how much coverage is right for you, State Farm can help. Agent Scott Underwood can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include the age you are now, your health status, and sometimes even body weight. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your unique situation and needs.

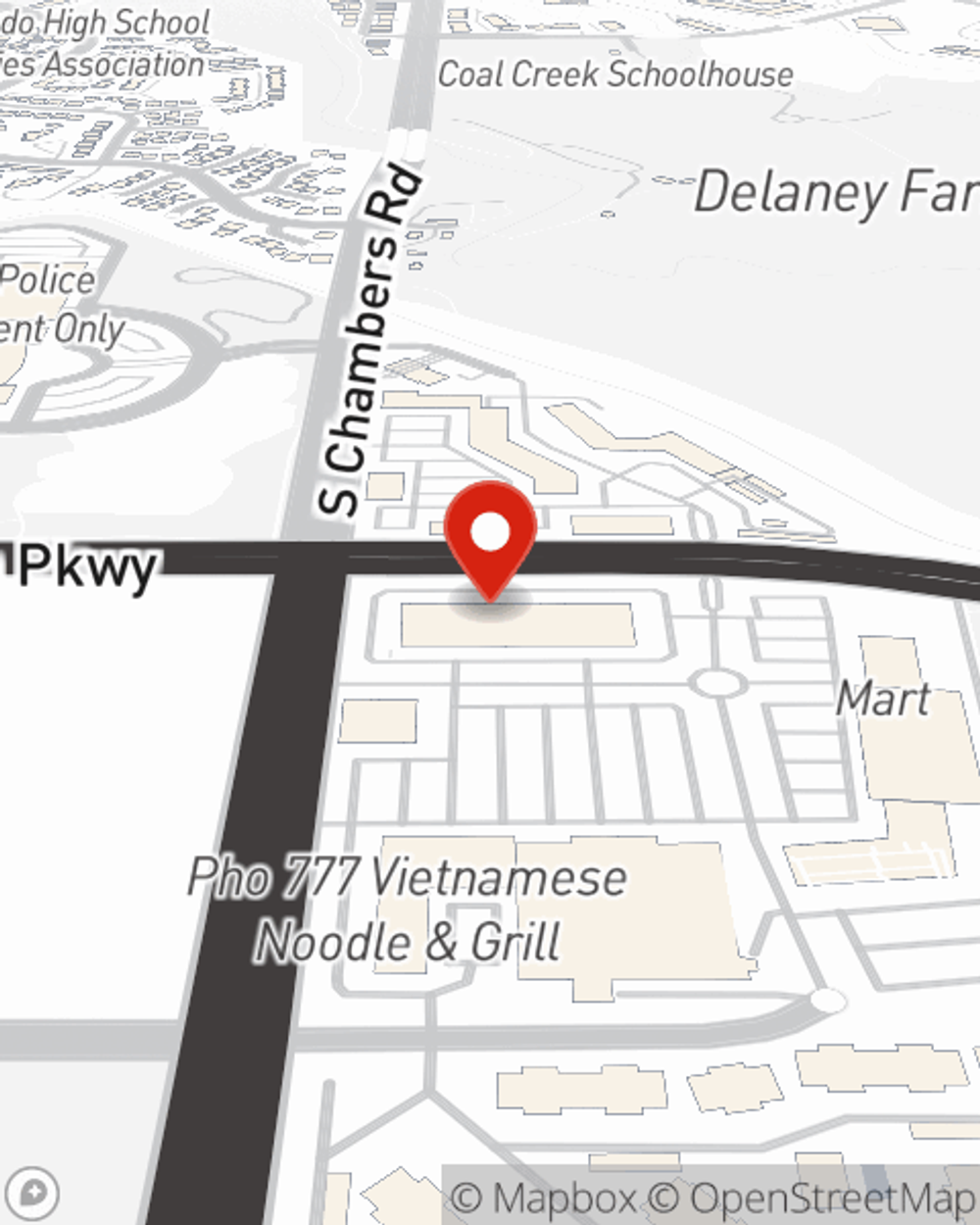

It's never a bad time to make sure your loved ones have coverage against the unexpected. Reach out to Scott Underwood's office to explore what State Farm can do for you.

Have More Questions About Life Insurance?

Call Scott at (303) 745-3174 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Scott Underwood

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.